Clearcover Integrates with Tesla for Enhanced EV Risk Scoring

In a significant development for the electric vehicle (EV) insurance landscape, Clearcover, a tech-centric insurance company, has announced its integration with Tesla to enhance risk scoring for electric vehicles. This strategic partnership aims to leverage Tesla’s advanced data capabilities to refine the accuracy of risk assessments, thus offering more precise insurance solutions tailored for EV owners.

With the global shift towards sustainable transportation, the demand for electric vehicles is on a rapid rise. According to the International Energy Agency, global EV sales surged by over 40% in 2022, underscoring the growing commitment to reducing carbon emissions. As such, the insurance industry faces new challenges in accurately evaluating the risks associated with EVs, which differ significantly from traditional combustion engine vehicles.

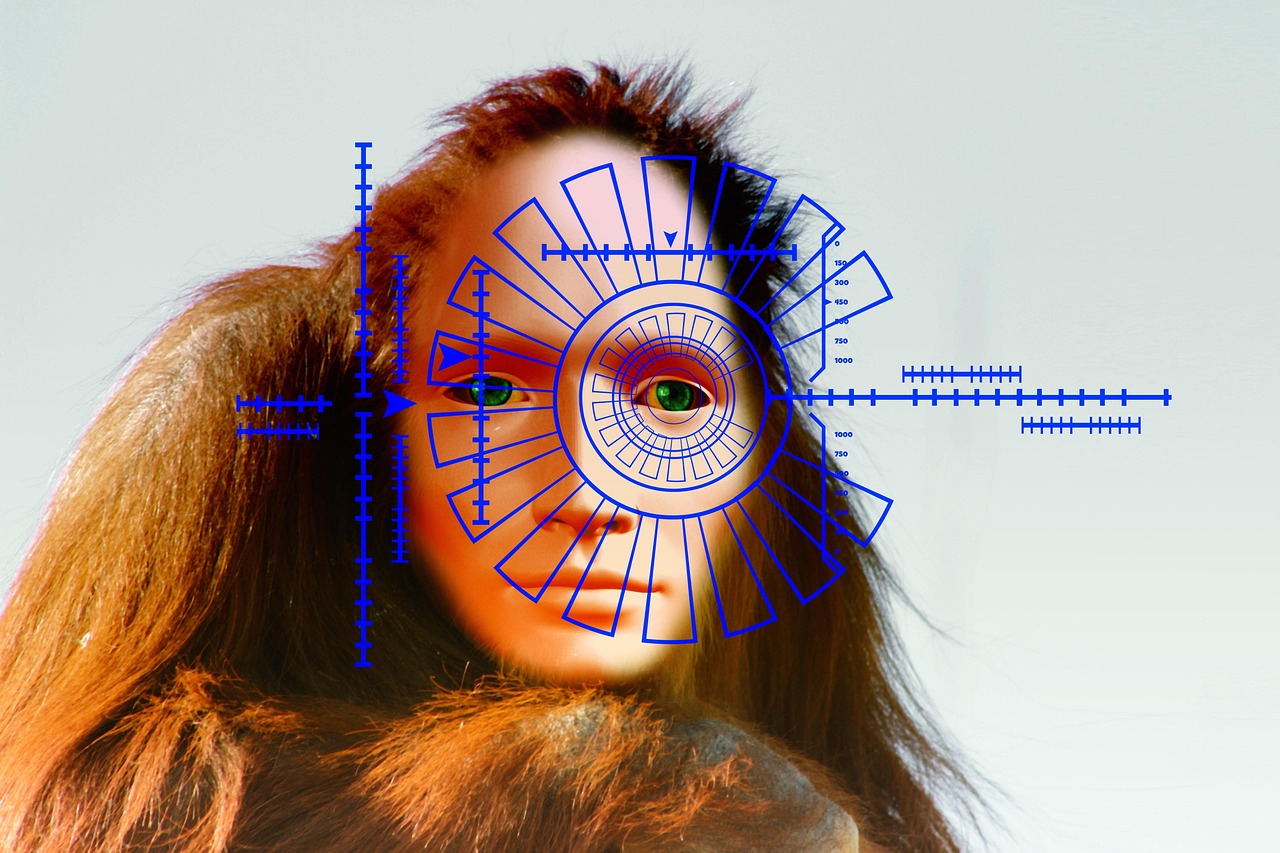

Clearcover, known for its innovative approach to auto insurance, and Tesla, a leader in the EV market, are combining their technological prowess to address these challenges. The integration focuses on utilizing Tesla’s vehicle data, which includes real-time information on driving behavior, vehicle performance, and environmental conditions. This data, when analyzed through Clearcover’s advanced algorithms, enables a more sophisticated risk assessment model.

The integration offers several advantages:

- Enhanced Accuracy: By utilizing real-time data from Tesla vehicles, Clearcover can provide more accurate and individualized risk assessments, moving beyond traditional metrics to consider driving patterns and vehicle usage.

- Tailored Insurance Products: The partnership allows for the development of customized insurance products that better reflect the unique characteristics and risks of EVs, potentially resulting in more competitive pricing for consumers.

- Data-Driven Insights: The collaboration offers deeper insights into EV risk factors, contributing to broader industry knowledge and potentially influencing future policy formulations.

This collaboration between Clearcover and Tesla is a testament to the growing intersection of technology and insurance. As vehicles become more connected and data-driven, the insurance industry is poised to undergo significant transformation, driven by data analytics and machine learning. By integrating real-time vehicle data, insurers can transition from reactive to proactive risk management strategies.

Globally, insurers are increasingly recognizing the potential of data integration with automakers. In Europe, companies like AXA and Allianz are also exploring similar collaborations to keep pace with the rapid evolution of the automotive industry. The partnership between Clearcover and Tesla sets a precedent for how insurers and automakers can work together to improve product offerings and customer satisfaction in the EV sector.

However, this integration also raises important considerations regarding data privacy and security. Ensuring that customer data is protected and used responsibly is paramount. Both Clearcover and Tesla are committed to adhering to strict data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States.

As the EV market continues to grow, the collaboration between Clearcover and Tesla is a forward-thinking step towards creating a more efficient and accurate insurance ecosystem. By harnessing the power of data, the partnership not only enhances risk assessment capabilities but also paves the way for future innovations in the insurance sector.