PNC Introduces Robo Retirement Calculator to Enhance Financial Planning

In a significant move to bolster its suite of digital financial tools, PNC Financial Services Group has unveiled a new robo retirement calculator. This innovative technology aims to guide users in planning their retirement more effectively by leveraging advanced algorithms and user-friendly design to offer personalized financial insights.

PNC’s robo retirement calculator is designed to meet the growing demand for digital financial advisory services, which have gained substantial traction in recent years. The rise of fintech solutions has been a global phenomenon, driven by the increasing comfort of individuals and businesses with digital tools that provide sophisticated financial analysis and recommendations.

The robo retirement calculator is engineered to analyze a range of variables including current savings, expected retirement age, lifestyle preferences, and anticipated expenses. By inputting these details, users receive a tailored retirement plan that outlines estimated savings needs and suggests potential investment strategies. This empowers users to make informed decisions regarding their financial futures.

PNC’s implementation of this digital tool reflects a broader trend within the banking and financial services industry. As traditional financial institutions face competition from fintech startups, many are integrating digital solutions to enhance their service offerings. Robo-advisors, in particular, have seen a surge in adoption due to their ability to offer cost-effective, accessible, and personalized financial advice.

According to a 2023 report by the Global Fintech Adoption Index, the use of robo-advisory services has increased by 30% globally over the past two years. This growth is largely attributed to the convenience and efficiency that digital tools offer, allowing users to manage their finances with greater flexibility and ease.

PNC’s initiative is also aligned with the evolving expectations of tech-savvy consumers who value seamless digital experiences. The robo retirement calculator offers a user-friendly interface, which is crucial in ensuring accessibility for a diverse range of users. By simplifying complex financial concepts, the tool enables users to engage with their retirement planning in a more intuitive and less intimidating manner.

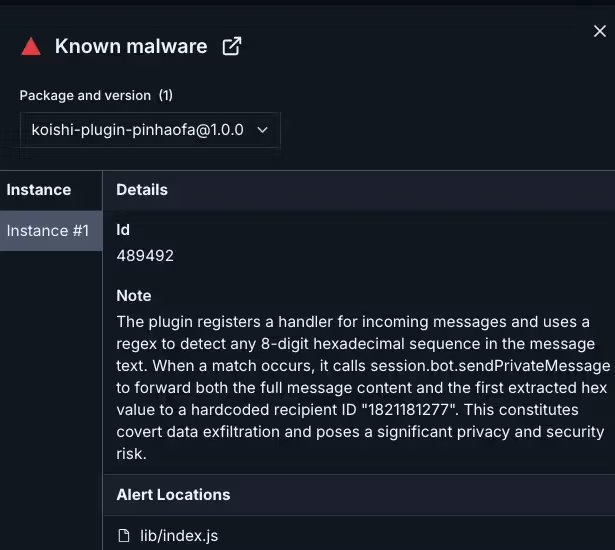

Moreover, PNC’s emphasis on data security and privacy is a critical component of its digital offerings. As the financial industry continues to digitize, safeguarding sensitive customer information remains a top priority. The robo retirement calculator is equipped with robust security measures to protect user data, ensuring that personal and financial information is handled with the utmost care.

In conclusion, PNC’s launch of the robo retirement calculator underscores the dynamic changes within the financial services sector, driven by technological innovation and evolving customer expectations. As digital tools become an integral part of financial planning, institutions like PNC are poised to lead the charge in providing comprehensive solutions that cater to the needs of the modern consumer. This development not only enhances PNC’s competitive edge but also contributes to the broader transformation of the financial landscape, where digital and traditional services converge to offer unparalleled value to clients worldwide.