ABN AMRO Joins Digital Euro Sandbox: Advancing Europe’s Digital Currency Initiative

ABN AMRO, a prominent financial institution, has announced its participation in the digital euro sandbox initiative, marking a significant step in the European Union’s exploration of a central bank digital currency (CBDC). This move aligns with the broader efforts by the European Central Bank (ECB) and its partners to evaluate the viability and potential impact of a digital euro on the continent’s financial landscape.

The digital euro project represents an important aspect of Europe’s digital transformation strategy, aiming to provide a secure and efficient payment solution that complements cash and meets the evolving needs of digital economies. As a key player in this initiative, ABN AMRO will contribute its expertise in digital banking and innovation to help shape the future of European digital currency.

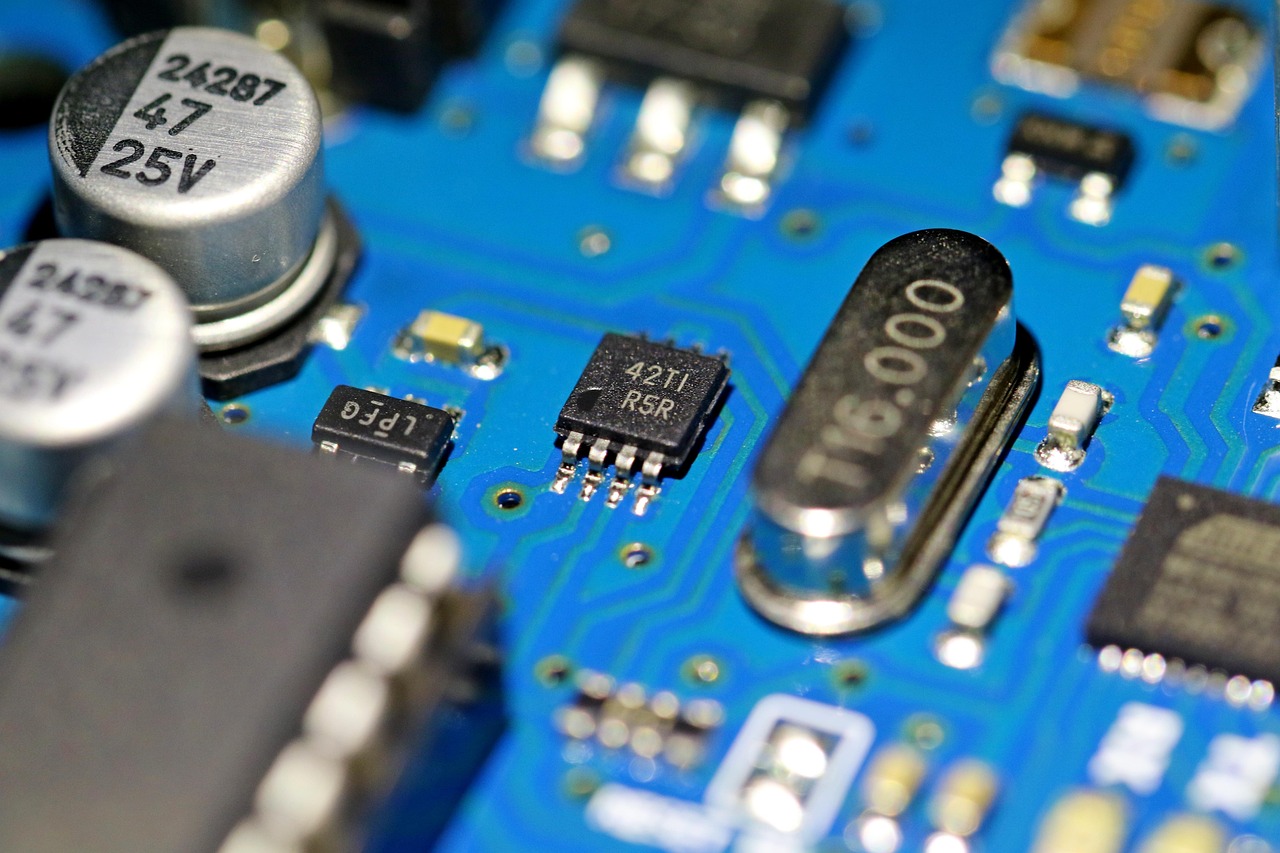

This participation underscores the bank’s commitment to pioneering advancements in digital finance, reflecting a global trend where traditional financial institutions are increasingly engaging with digital currency initiatives. The digital euro sandbox is designed as a testing environment where financial entities can explore the technical and operational facets of a potential digital euro, ensuring that it is robust, secure, and user-friendly.

ABN AMRO’s involvement in the sandbox will include collaboration with other financial institutions, technology providers, and regulatory bodies to explore the following key areas:

- Technical Infrastructure: Evaluating the technical requirements and infrastructure needed to support a digital euro, including blockchain technology, distributed ledger systems, and interoperability with existing financial networks.

- Security and Privacy: Ensuring that the digital euro is secure from cyber threats while maintaining user privacy and adhering to stringent data protection regulations.

- Monetary Policy Implications: Analyzing how a digital euro might affect monetary policy, financial stability, and the role of the central bank in the digital age.

- User Experience: Designing a user-friendly interface and seamless integration with current payment systems to facilitate widespread adoption.

The digital euro initiative is part of a larger global movement towards exploring CBDCs. Various central banks worldwide, including the People’s Bank of China and the U.S. Federal Reserve, are investigating or piloting their digital currencies. These efforts are driven by the need to modernize the financial system, enhance payment efficiencies, and address the challenges posed by private digital currencies and stablecoins.

European regulators are particularly focused on ensuring that a digital euro complements existing fiscal and monetary frameworks, while also supporting innovation and competitiveness in the global market. The ECB has emphasized that a digital euro would be a public good, providing Europeans with a cost-free, secure, and widely accessible digital payment option.

ABN AMRO’s participation in the sandbox is expected to facilitate valuable insights and data that will inform the ECB’s decision-making process. The outcomes of these exploratory efforts will play a crucial role in determining the feasibility of issuing a digital euro, with the ultimate goal of enhancing the efficiency and resilience of the European financial system.

As the digital euro project progresses, stakeholders will continue to address critical questions concerning regulatory compliance, technological challenges, and economic impacts. ABN AMRO, along with other participants, will be at the forefront of these discussions, contributing to the shaping of a future-proof digital currency framework for Europe.

In conclusion, ABN AMRO’s involvement in the digital euro sandbox represents a proactive step in navigating the complexities of digital currencies. Through collaboration and innovation, the bank aims to support the development of a secure, efficient, and inclusive financial ecosystem that meets the demands of the modern digital age.