AI Enables Instant Triage in Parametric Claims

In the fast-evolving world of insurance, parametric claims have emerged as a game-changer, offering a streamlined approach to compensation that is both efficient and transparent. With artificial intelligence (AI) at the forefront, the process of triage in parametric claims has become almost instantaneous, transforming how insurers and policyholders interact and respond to events.

Parametric insurance, unlike traditional indemnity-based models, is based on predefined triggers and payouts. These triggers are often linked to measurable parameters like the magnitude of an earthquake, wind speed in a storm, or the amount of rainfall. Once the trigger conditions are met, payouts are automatically processed, eliminating the need for lengthy claims assessments and negotiations.

AI plays a pivotal role in enhancing this model by leveraging data analytics, machine learning, and real-time monitoring to facilitate immediate decision-making and payout processing. This technological integration not only accelerates the claims process but also improves accuracy, reduces fraud, and enhances customer satisfaction.

How AI Transforms Parametric Claims

The integration of AI into parametric claims processing brings several key advantages:

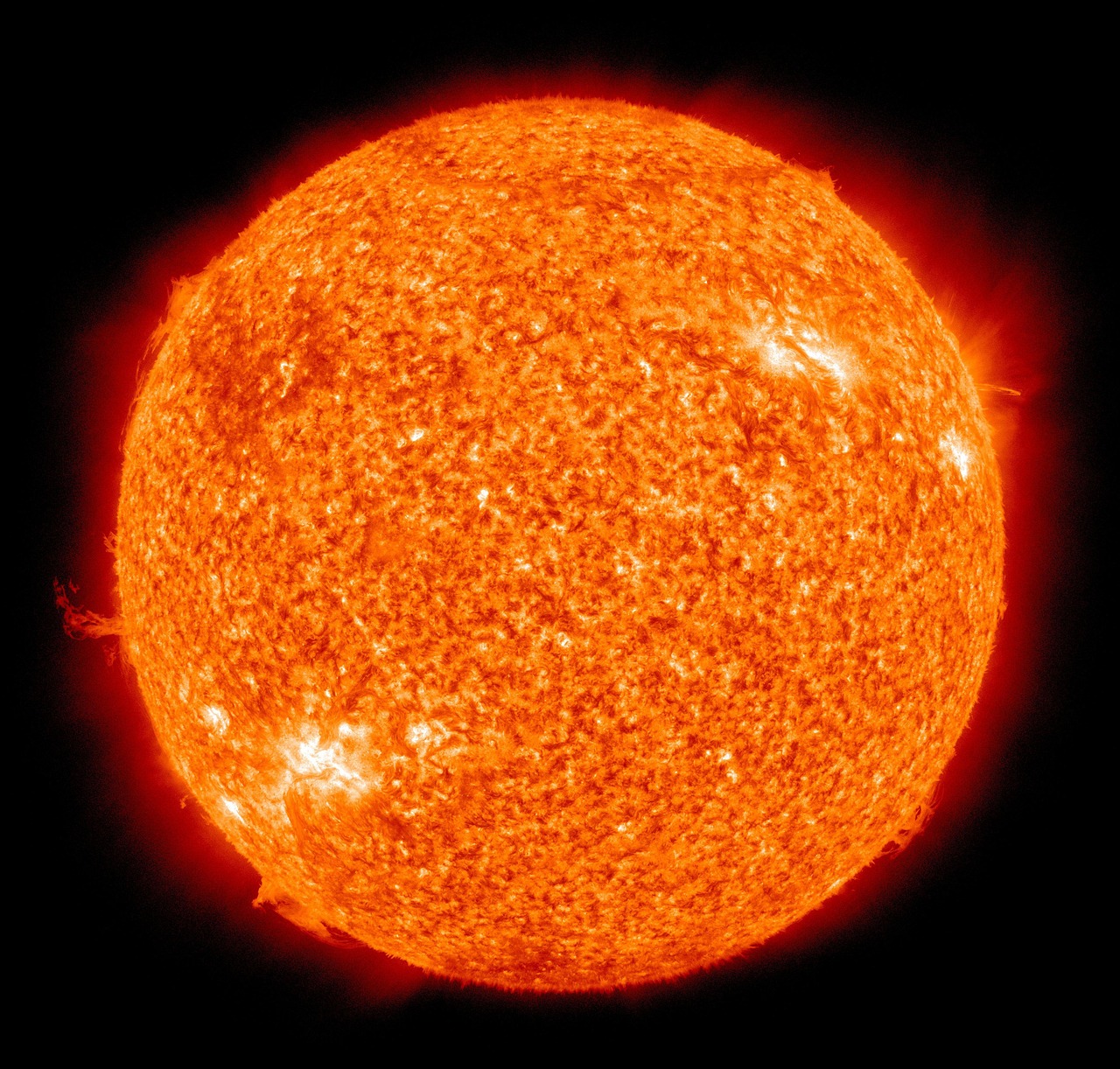

- Data Analysis and Prediction: AI systems can process vast amounts of data from diverse sources in real-time. For instance, satellite imagery, IoT devices, and climate models can be analyzed to predict and verify the occurrence of an insured event.

- Automation of Claims Processing: Once an event is verified through AI-driven data analysis, the claims process can be automatically initiated without human intervention. This leads to faster payouts and increased efficiency.

- Fraud Detection: AI algorithms are adept at identifying anomalies and patterns that may indicate fraudulent activity, thereby safeguarding insurers from potential losses.

- Enhanced Customer Experience: With immediate triage and minimal manual processes, policyholders experience a seamless claims process, reinforcing trust in the insurance provider.

Global Context and Adoption

Globally, the adoption of AI in parametric claims is gaining momentum. Countries prone to natural disasters, such as Japan and the United States, have been at the forefront of implementing these technologies. In these regions, the ability to quickly assess and respond to catastrophic events is critical for economic stability and recovery.

Moreover, emerging markets in Africa and South America are exploring parametric insurance as a viable solution to address challenges in agricultural sectors, where climate variability can have devastating impacts on livelihoods. By using AI to monitor weather patterns and crop conditions, insurers can offer products that provide timely support to farmers.

Challenges and Considerations

Despite its advantages, the integration of AI in parametric claims is not without challenges. Data privacy and security concerns remain paramount, as the reliance on large datasets and real-time monitoring raises questions about the protection of sensitive information.

Additionally, the accuracy of AI models in predicting and verifying events is crucial. Errors or biases in data can lead to incorrect payouts, undermining the credibility of parametric insurance solutions. Continuous improvement of AI algorithms and rigorous testing are essential to ensure reliability and fairness.

Conclusion

The use of AI in parametric claims represents a significant advancement in the insurance industry, offering a model that is both efficient and responsive to the needs of modern policyholders. As technology continues to evolve, the potential for AI to further reshape the landscape of insurance is immense, promising a future where claims processing is not only instantaneous but also more equitable and accessible.