AI Maps Personal Network Connections for Fraud Analysis

In an era where digital transactions and online interactions are proliferating, the risk of fraud has become a pressing concern for businesses and individuals alike. Artificial Intelligence (AI) is increasingly being leveraged to combat this threat by mapping personal network connections to detect and prevent fraudulent activities. This article explores how AI is reshaping fraud analysis by utilizing advanced network mapping techniques, offering insights into its implications for global security and business operations.

Fraud is a complex issue that often involves intricate networks of collaborators and unsuspecting participants. Traditional methods of detecting fraud, which largely relied on manual analysis and historical data, are often inadequate in the face of increasingly sophisticated schemes. AI offers a more dynamic and comprehensive approach by analyzing vast amounts of data at scale and identifying patterns that may be indicative of fraudulent behavior.

The Role of AI in Mapping Network Connections

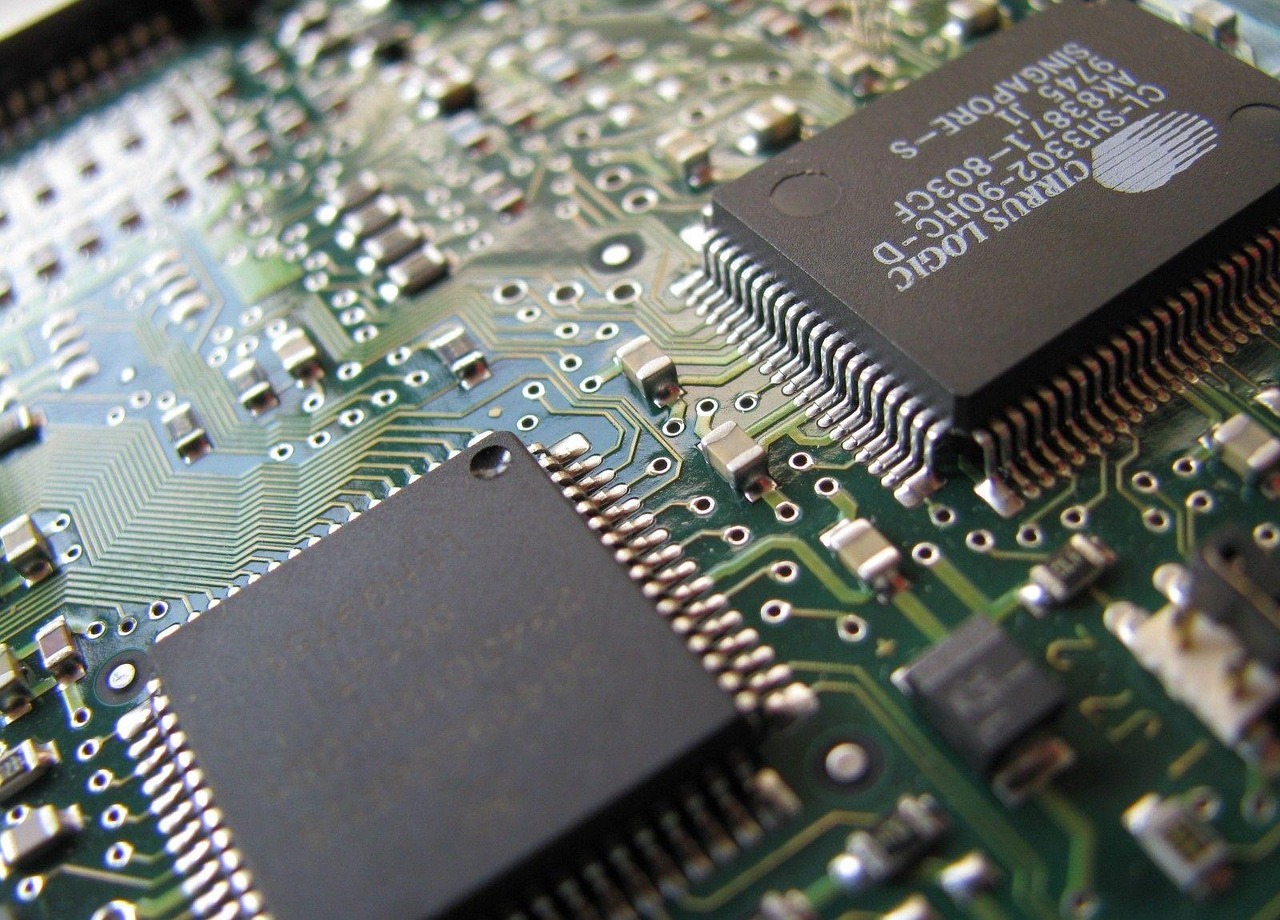

AI technologies, particularly machine learning and deep learning algorithms, are at the forefront of mapping personal network connections for fraud analysis. These technologies can process large datasets to uncover hidden relationships between entities, such as individuals, organizations, and transactions. By constructing a detailed network map, AI can identify anomalies that may signify fraudulent activities.

- Data Collection: AI systems gather data from a variety of sources, including social media platforms, financial transactions, and communication records. This data serves as the foundation for mapping personal and professional networks.

- Pattern Recognition: Machine learning algorithms are adept at recognizing patterns and correlations within the data. These patterns help in identifying unusual activities or connections that deviate from the norm.

- Predictive Analysis: By analyzing historical data, AI can predict potential future fraud attempts, enabling proactive measures to be taken.

One of the key advantages of AI in fraud analysis is its ability to process and analyze data in real-time. This capability allows for immediate detection and response to potential threats, significantly reducing the window of opportunity for fraudsters.

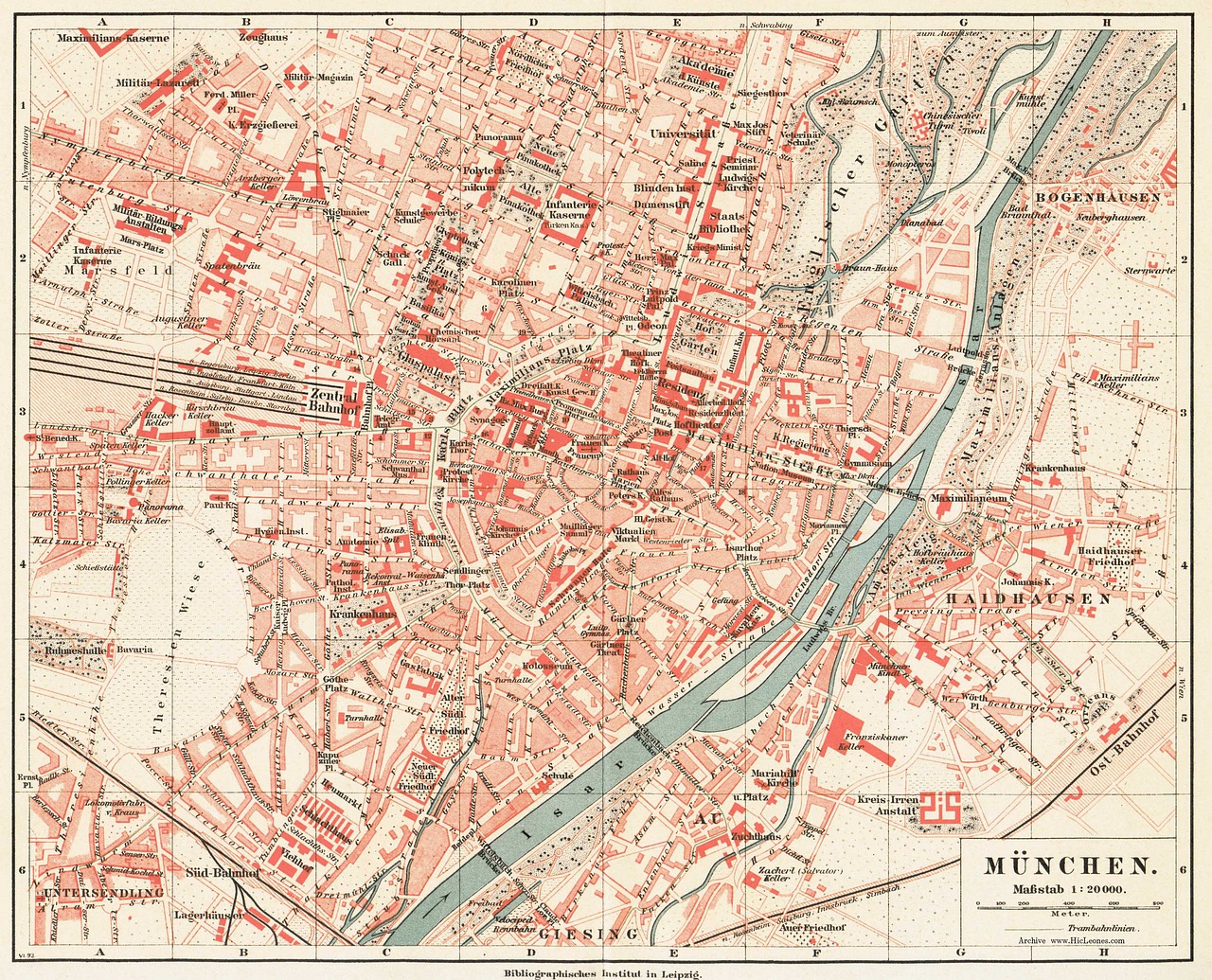

Global Context and Implications

Globally, fraud is a significant issue that affects businesses and economies. The Association of Certified Fraud Examiners (ACFE) estimates that organizations lose 5% of their revenue to fraud annually. As digital transactions continue to grow, the potential for fraud increases, making the need for effective detection tools more critical.

AI’s application in fraud analysis is not limited to any single industry. Financial institutions, e-commerce platforms, and even government agencies are utilizing AI to protect against fraudulent activities. For instance, banks are employing AI to monitor transactions and flag suspicious activities, while e-commerce platforms use AI to authenticate users and prevent identity theft.

Challenges and Ethical Considerations

While AI presents a powerful tool for fraud analysis, it is not without challenges. One of the primary concerns is data privacy. The collection and analysis of personal data raise questions about consent and ethical use. Organizations must ensure compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union, to maintain trust and transparency.

Moreover, the accuracy of AI systems depends on the quality of the data they receive. Inaccurate or biased data can lead to false positives or negatives, potentially implicating innocent parties or missing fraudulent activities. Continuous refinement and validation of AI models are essential to maintain their efficacy and reliability.

The Future of AI in Fraud Analysis

As AI technologies continue to evolve, their role in fraud analysis is expected to expand. Future advancements may include more sophisticated algorithms capable of understanding complex human behaviors and motivations, further enhancing the ability to detect and prevent fraud. Additionally, the integration of AI with other emerging technologies, such as blockchain, could offer new avenues for securing transactions and verifying identities.

In conclusion, AI’s ability to map personal network connections for fraud analysis represents a significant leap forward in the fight against fraud. By harnessing the power of AI, organizations can better protect themselves and their clients from the ever-evolving threat landscape. As the technology matures, it will undoubtedly play a pivotal role in shaping a safer, more secure digital world.