Airbase Develops Machine Learning-Driven Invoice Fraud Detection to Combat Financial Fraud

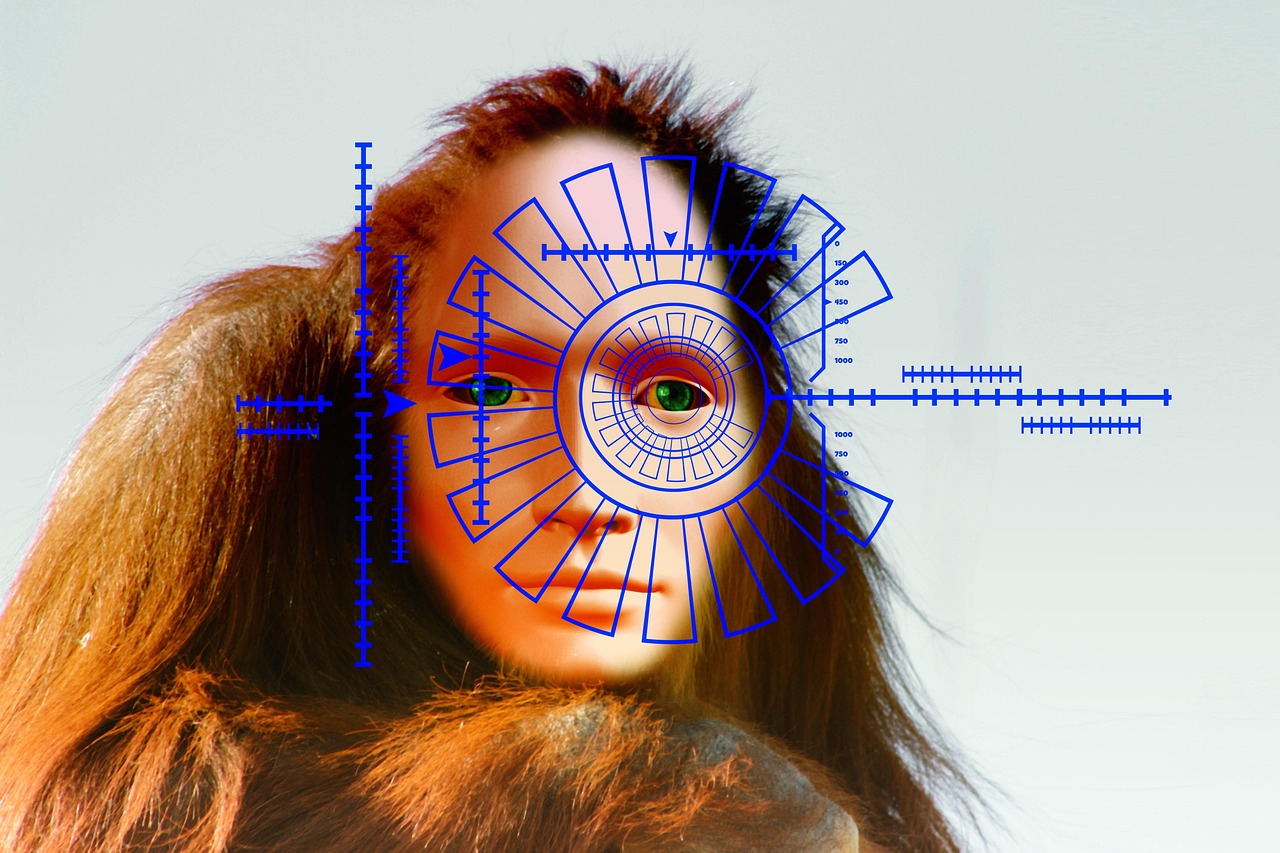

In an era where financial transactions are increasingly digitized, the risk of invoice fraud has emerged as a significant concern for businesses worldwide. Addressing this critical issue, Airbase, a leading spend management platform, has announced the development of an advanced machine learning-driven invoice fraud detection system. This innovation aims to bolster the defense mechanisms of businesses against fraudulent activities that can result in substantial financial losses.

Invoice fraud typically involves the manipulation of billing documents to deceive companies into making unwarranted payments. Tactics employed by fraudsters range from simple errors to sophisticated schemes involving fake invoices and vendor impersonation. As businesses transition to digital platforms for efficiency and scalability, the complexity and frequency of such fraud attempts have escalated, necessitating robust technological solutions.

Airbase’s new system employs machine learning algorithms to detect anomalies and patterns indicative of fraudulent activities. By analyzing historical transaction data, the system can differentiate between legitimate and suspicious invoices with greater accuracy. This approach not only enhances the ability to identify potential fraud but also reduces the burden on finance teams who traditionally rely on manual checks and audits.

The incorporation of machine learning in fraud detection presents several advantages:

- Improved Accuracy: Machine learning models can analyze vast amounts of data quickly and identify patterns that may be imperceptible to human reviewers, thus improving the precision of fraud detection.

- Scalability: As businesses expand, the volume of transactions increases, making manual monitoring impractical. Machine learning systems can scale effortlessly to accommodate growing data sets.

- Real-time Detection: With the ability to process data continuously, these systems can flag suspicious activities in real-time, allowing for prompt intervention and mitigation.

- Adaptability: The self-learning nature of machine learning algorithms enables them to adapt to new fraud tactics, ensuring that detection capabilities evolve alongside the methods employed by fraudsters.

Globally, the impact of invoice fraud is significant. According to the Association of Certified Fraud Examiners, businesses can lose up to 5% of their annual revenues to fraud, with invoice-related fraud being one of the most common forms. The introduction of machine learning technologies in this domain represents a pivotal shift towards more proactive and efficient fraud management strategies.

Airbase is not alone in this endeavor. The integration of artificial intelligence and machine learning in financial systems is a growing trend, with numerous organizations investing in these technologies to safeguard their operations. The global AI in the financial services market, as reported by various industry analyses, is expected to continue its rapid growth, underscoring the importance of such innovations.

While the benefits of machine learning-driven fraud detection are clear, the implementation of such systems must be managed carefully. Ensuring data privacy and compliance with regulatory standards is critical. Moreover, businesses need to integrate these systems with existing workflows seamlessly to maximize their effectiveness without disrupting operations.

In conclusion, Airbase’s initiative to develop a machine learning-driven invoice fraud detection system represents a significant advancement in the fight against financial fraud. By leveraging cutting-edge technology, businesses can enhance their defenses, protect their financial assets, and maintain trust with their stakeholders. As the landscape of financial fraud continues to evolve, such innovations will be indispensable in ensuring the security and integrity of financial transactions.