APIs Empower Developers to Integrate Stock Trading Features

In the rapidly evolving landscape of financial technology, Application Programming Interfaces (APIs) have emerged as a pivotal tool, enabling developers to seamlessly integrate stock trading functionalities into their applications. As the demand for digital financial services grows, APIs serve as bridges between traditional trading systems and modern software solutions, delivering unprecedented access and capabilities to a global audience.

APIs, essentially sets of protocols and tools for building software applications, allow developers to incorporate complex trading features without needing to build systems from scratch. This integration is transforming the way financial services are offered, making it easier for fintech companies to provide robust trading platforms to their users.

One of the primary advantages of using APIs in stock trading applications is the speed and efficiency they offer. APIs enable real-time access to market data, allowing applications to execute trades, retrieve stock prices, and manage portfolios instantaneously. This capability is crucial in the fast-paced world of trading, where milliseconds can mean the difference between profit and loss.

Globally, the adoption of trading APIs is on the rise, driven by the increasing popularity of algorithmic and high-frequency trading. These APIs provide the necessary infrastructure for developers to implement complex trading algorithms that can operate at speeds far beyond human capability. Additionally, APIs support a variety of programming languages and frameworks, making them accessible to a broad range of developers with different technical backgrounds.

The integration of APIs in stock trading is not limited to speed and efficiency. They also enhance the security and compliance of trading applications. Through secure authentication mechanisms and encrypted data transmission, APIs help protect sensitive financial information. Furthermore, many APIs are designed to comply with global financial regulations, ensuring that applications using these interfaces adhere to legal standards.

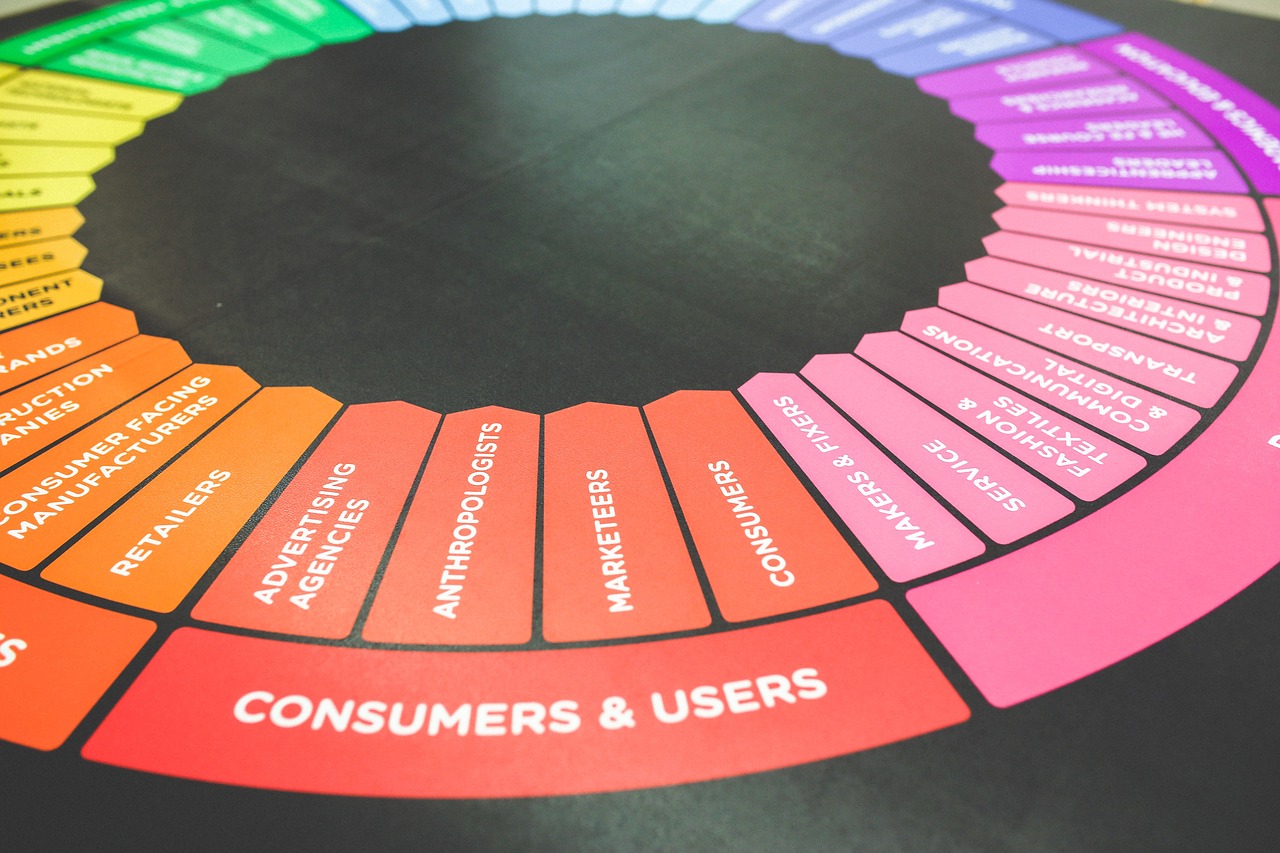

Another significant benefit of using APIs is their ability to foster innovation by providing developers with access to a vast array of trading services and functionalities. For instance, APIs can offer features such as:

- Access to historical and real-time market data

- Automated order execution and management

- Portfolio tracking and analysis

- Risk management tools

- Customizable trading strategies

The global context further emphasizes the importance of APIs in stock trading. With the rise of mobile and online trading platforms, investors across different geographical locations can access global markets from their devices. This democratization of trading has been facilitated by APIs, which provide the necessary infrastructure to connect disparate financial systems and markets.

Financial institutions, brokerage firms, and fintech startups are increasingly leveraging APIs to enhance their service offerings and remain competitive. By partnering with API providers, these entities can quickly deploy new features, scale their operations, and tap into new markets without the substantial investment and time required to develop proprietary trading systems.

However, while the benefits of APIs are substantial, developers must also consider the challenges associated with their use. Ensuring the reliability and uptime of API services, managing data privacy concerns, and navigating the complexities of integration are critical factors that must be addressed to fully realize the potential of APIs in stock trading.

In conclusion, APIs are revolutionizing the integration of stock trading features in modern applications, offering speed, efficiency, security, and innovation. As the digital transformation of financial services continues, APIs will undoubtedly play a crucial role in shaping the future of stock trading, enabling developers to deliver advanced trading solutions that meet the demands of a tech-savvy global audience.