APIs Support Financial Habit Scoring: Transforming Personal Finance Through Technology

In the ever-evolving landscape of financial technology, Application Programming Interfaces (APIs) have emerged as pivotal tools in revolutionizing personal finance management. Among their many applications, APIs are increasingly being leveraged to support financial habit scoring, a process that is reshaping how individuals and institutions understand and manage financial behaviors.

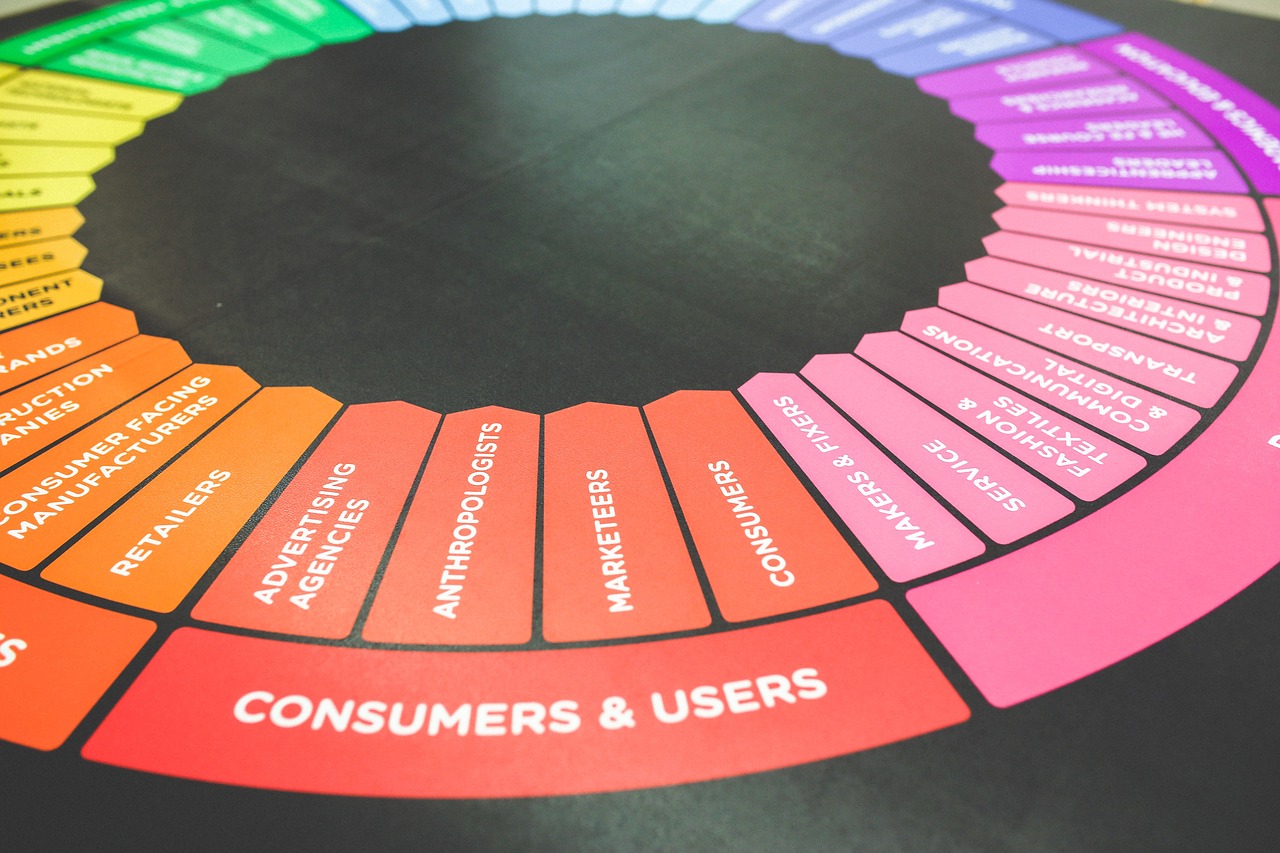

Financial habit scoring refers to the assessment and analysis of an individual’s financial behaviors to generate a score reflecting their financial health. This score can influence credit ratings, loan approvals, and personalized financial advice. APIs facilitate this process by enabling seamless data integration, analysis, and sharing between disparate financial systems and platforms.

Globally, the adoption of APIs for financial habit scoring is gaining traction, driven by a confluence of technological advancements and regulatory changes. For instance, the European Union’s Second Payment Services Directive (PSD2) requires banks to open their data to third-party providers through APIs, fostering innovation and competition in financial services.

The Role of APIs in Financial Habit Scoring

APIs function as intermediaries that allow different software applications to communicate and exchange data. In the context of financial habit scoring, they enable the following:

- Data Aggregation: APIs facilitate the collection of an individual’s financial data from various sources, such as bank accounts, credit cards, and investment portfolios. This comprehensive data set is crucial for accurate habit scoring.

- Real-time Analysis: APIs allow for real-time data processing, providing up-to-date insights into an individual’s financial behaviors. This immediacy is essential for timely financial decision-making.

- Enhanced Security: By using APIs, financial institutions can ensure secure data transmission through encryption and authentication protocols, protecting sensitive financial information.

Global Context and Regulatory Environment

The global push towards open banking is a significant factor in the proliferation of APIs for financial habit scoring. Open banking initiatives, which emphasize interoperability and customer data portability, are gaining momentum worldwide. For example:

- Europe: PSD2 mandates that banks provide API access to customer data, subject to consent, enabling innovative financial services.

- United States: While not regulated like PSD2, there is a growing trend towards open banking, with major banks voluntarily offering API access.

- Asia-Pacific: Countries like Australia and Singapore are actively promoting open banking frameworks, encouraging the use of APIs for financial innovation.

Implications for Financial Institutions and Consumers

For financial institutions, leveraging APIs for financial habit scoring offers several advantages:

- Product Differentiation: By offering personalized financial products and advice based on habit scores, institutions can differentiate themselves in a competitive market.

- Risk Management: Accurate habit scoring helps in assessing credit risk more effectively, leading to better risk management strategies.

- Customer Engagement: APIs enable institutions to offer enhanced digital experiences, fostering greater customer engagement and satisfaction.

For consumers, the benefits are equally compelling:

- Financial Awareness: Access to habit scores can help individuals understand their financial behaviors and make informed decisions.

- Access to Services: More accurate financial assessments can expand access to credit and financial services for underserved populations.

- Data Control: With open banking, consumers have greater control over their data, allowing them to choose which services to use based on their scores.

Challenges and Future Directions

Despite the potential benefits, the integration of APIs for financial habit scoring is not without challenges. Data privacy concerns, interoperability issues, and the need for robust security measures remain significant hurdles. However, as technology evolves, these challenges are likely to be addressed, paving the way for more sophisticated and secure financial habit scoring systems.

Looking ahead, the continued collaboration between regulators, financial institutions, and technology providers will be essential in realizing the full potential of APIs in financial habit scoring. As this ecosystem matures, it holds the promise of transforming personal finance, making it more accessible, personalized, and secure for consumers worldwide.