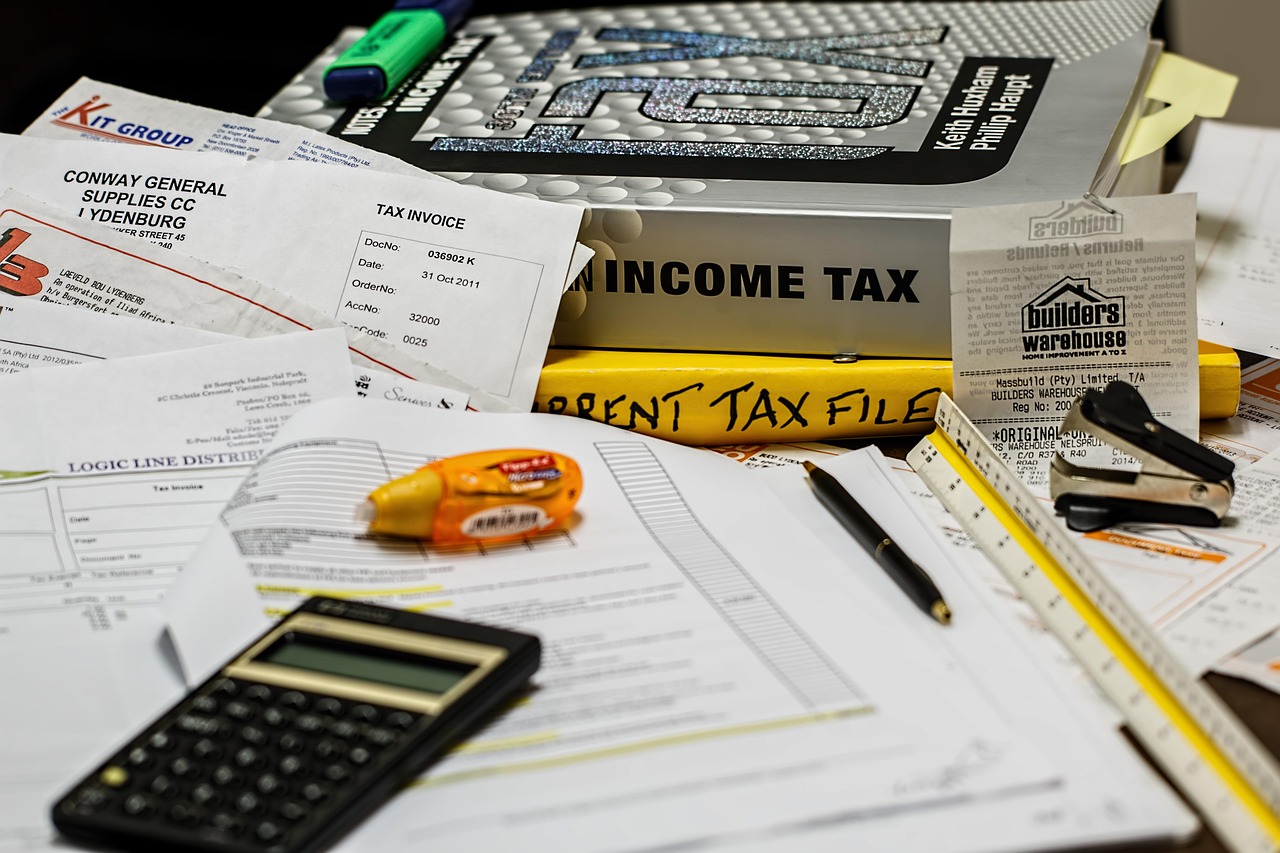

Budget Tools Provide Lifetime Spending Overviews

In an increasingly digitalized world, budget tools have become indispensable for individuals seeking to gain a comprehensive understanding of their financial habits. These tools are not just about tracking daily expenses or setting monthly budgets; they provide a lifetime overview of spending, enabling users to make informed financial decisions. As financial landscapes evolve globally, the importance of such tools cannot be overstated, particularly for professionals who need to manage complex financial portfolios.

Budget tools offer granular insights into spending behaviors over extended periods. By aggregating data from various sources such as bank accounts, credit cards, and investments, they present an integrated view of an individual’s financial life. This holistic approach is crucial for understanding long-term financial health and planning for future expenditures, savings, and investments.

One of the significant advantages of modern budget tools is their ability to adapt to the diverse financial systems worldwide. With globalization, professionals often deal with multiple currencies and financial regulations. Budget tools are equipped to handle these complexities, providing multi-currency support and compliance with various financial laws, making them essential for expatriates and international business professionals.

Here are some key features of budget tools that contribute to their effectiveness in providing lifetime spending overviews:

- Data Consolidation: By linking multiple financial accounts, budget tools consolidate data to provide a complete financial picture. This eliminates the need to manually track expenses across different platforms, saving time and reducing errors.

- Analytical Insights: Advanced analytics allow users to identify spending patterns, categorize expenses, and detect areas where savings can be optimized. These insights are vital for long-term financial planning and achieving specific financial goals.

- Forecasting and Planning: Many budget tools incorporate forecasting models that predict future spending based on historical data. This feature helps users in planning for significant life events such as buying a home, funding education, or retirement planning.

- Security and Privacy: Given the sensitive nature of financial data, budget tools prioritize security and privacy. They employ encryption and secure authentication methods to protect user information, ensuring that data remains confidential and secure.

The global context of financial management underscores the utility of budget tools. In regions with volatile economies, such tools can provide stability by helping users adapt to rapid financial changes. In more stable economies, they assist in optimizing wealth management strategies.

Furthermore, professionals in the technology sector are particularly well-placed to leverage these tools. With a high degree of tech literacy, they can navigate complex features and customize tools to suit their specific needs, integrating them with other digital services to enhance their overall financial management strategy.

In conclusion, budget tools are not merely instruments for tracking expenses; they are comprehensive systems that offer lifetime spending overviews. By providing detailed insights and facilitating strategic financial planning, they empower users to make informed decisions in a complex and ever-changing global economy. As technology continues to advance, the capabilities of these tools will likely expand, offering even greater precision and adaptability for financial management.