Expense Trackers Integrate with Smart Receipts: A New Era of Financial Management

In a world where digital transformation is reshaping every facet of our lives, the integration of expense trackers with smart receipts marks a significant advancement in personal and business finance management. As financial literacy becomes more crucial for both individuals and organizations, this integration offers a streamlined, accurate, and efficient way to manage expenses.

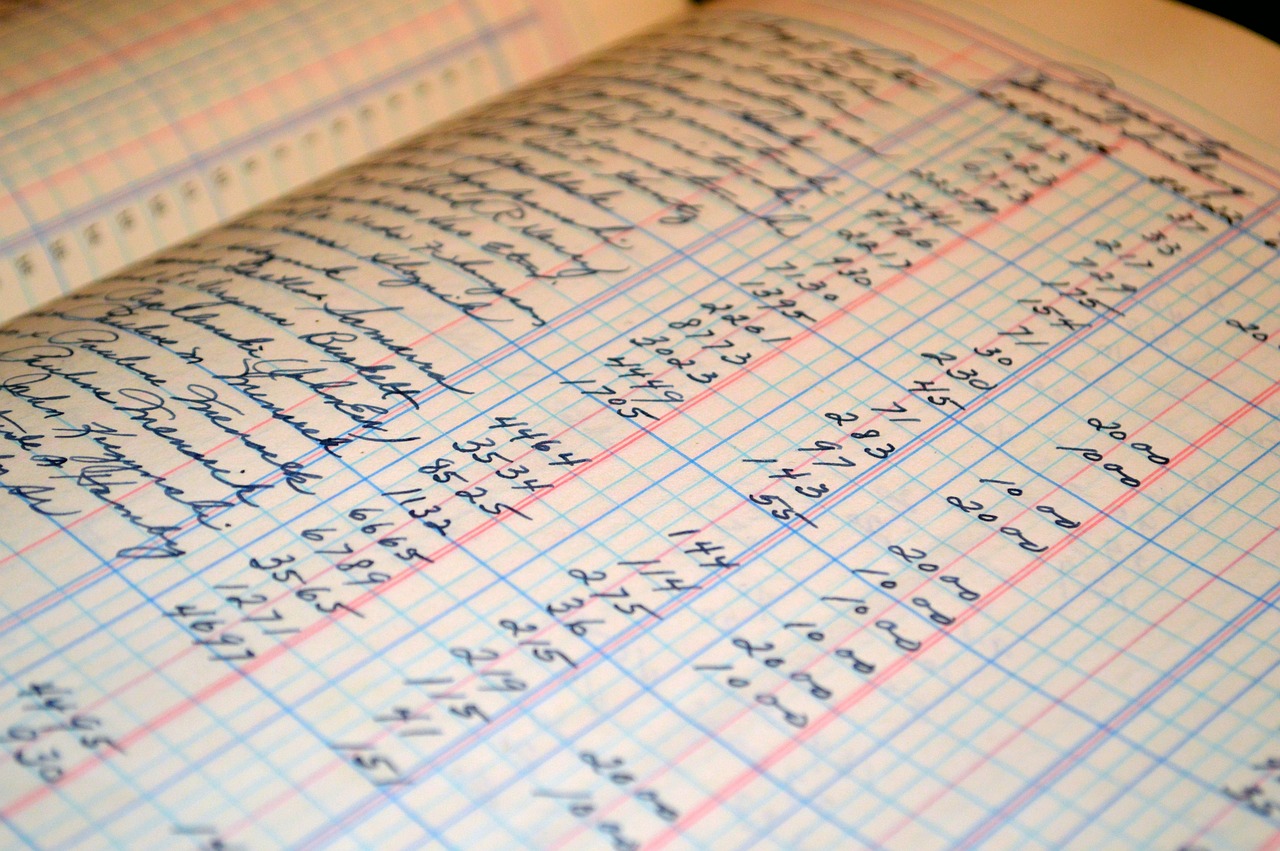

Expense tracking applications have been pivotal in helping users monitor their spending patterns, categorize expenses, and maintain budgeting discipline. However, the manual entry of data has often been a barrier, leading to inaccuracies and inefficiencies. The evolution of smart receipts offers a solution, effectively bridging the gap between purchase and record-keeping.

The Role of Smart Receipts

Smart receipts differ from traditional paper receipts by being digital, interactive, and data-rich. They provide not only the transaction details but also additional metadata such as time of purchase, vendor information, and even location data. This additional layer of information can be leveraged by expense trackers to automate the categorization and analysis of expenses.

Globally, the adoption of smart receipts is on the rise, driven by a combination of consumer demand for paperless alternatives and businesses seeking to streamline their operations. Countries like Sweden and Finland have seen significant adoption due to their advanced digital infrastructures, while others are quickly following suit.

Integration Benefits

The integration of smart receipts with expense trackers brings about numerous advantages:

- Enhanced Accuracy: By automating data entry, smart receipts minimize human errors, ensuring that financial records are precise.

- Time Efficiency: Users save time as expenses are automatically logged and categorized, reducing the need for manual entry.

- Improved Financial Insights: With rich data from smart receipts, expense trackers can provide more detailed analytics, helping users make informed financial decisions.

- Sustainability: The reduction in paper use contributes to environmental conservation, aligning with global sustainability goals.

Challenges and Considerations

Despite the evident benefits, there are challenges to this integration. Privacy and data security remain crucial concerns. As smart receipts contain sensitive financial data, ensuring that this information is encrypted and securely stored is paramount. Additionally, the interoperability between different systems and standards for smart receipts must be addressed to facilitate seamless integration across various platforms.

The global landscape of digital receipts is diverse, with different countries having varying regulations and technological infrastructures. Therefore, companies looking to implement such integrations must consider these regional differences to ensure compliance and functionality.

Future Outlook

The future of expense management lies in the continued evolution and integration of intelligent technologies. As artificial intelligence and machine learning advance, the potential for more sophisticated analysis and prediction of spending patterns becomes feasible. Moreover, as more businesses adopt digital receipts, the scope for innovation in this field will expand.

In conclusion, the integration of expense trackers with smart receipts signifies a major step forward in financial management technology. It offers a glimpse into a future where managing finances is not only more efficient but also more insightful. For individuals and businesses aiming to optimize their financial strategies, embracing this integration is not just beneficial but necessary in the digital age.