FreshBooks Integrates Machine Learning for Enhanced Expense Categorization

In a significant advancement for financial management software, FreshBooks has integrated machine learning (ML) technology to improve its expense categorization capabilities. This development aims to streamline financial operations for small businesses and freelancers worldwide, leveraging the power of artificial intelligence to enhance accuracy and efficiency.

As businesses increasingly seek to optimize their financial management processes, the integration of machine learning technologies into accounting software is becoming more prevalent. FreshBooks, a leading cloud-based accounting software provider, is at the forefront of this trend, utilizing ML to automate and refine how expenses are categorized.

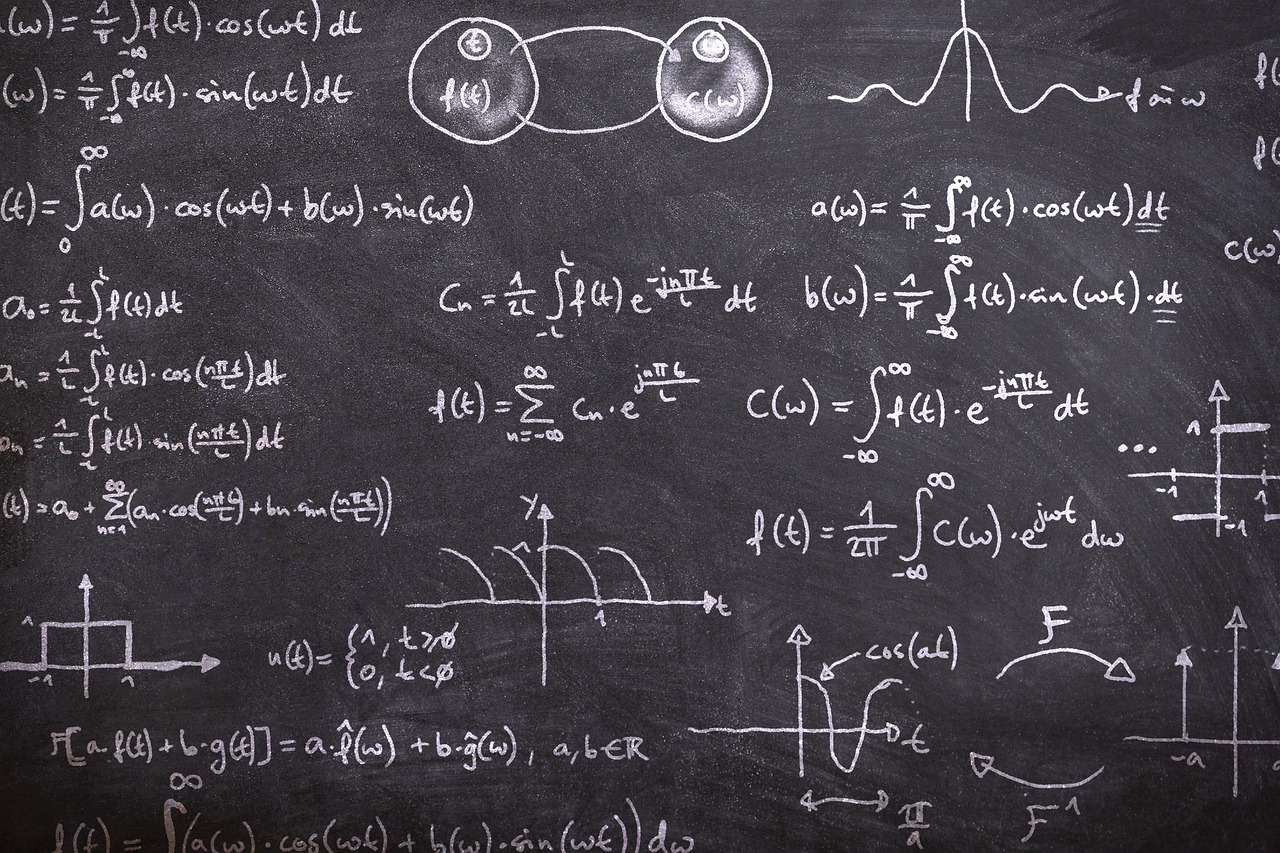

How Machine Learning Enhances Expense Categorization

The primary goal of integrating machine learning into FreshBooks is to provide more accurate and efficient expense categorization. Through the use of sophisticated algorithms, the software can learn from historical data and recognize patterns across various transactions. This machine learning capability allows FreshBooks to:

- Automate Repetitive Tasks: By learning from historical transaction data, the system can automatically categorize expenses without manual input, thereby saving time and reducing the workload for users.

- Improve Accuracy: Machine learning models can analyze large volumes of data to identify subtle patterns, resulting in more accurate categorizations compared to traditional rule-based systems.

- Adapt to Changing Patterns: As business expenses evolve, machine learning algorithms can adapt to new spending behaviors, ensuring that categorizations remain relevant and precise over time.

Global Context and Implications

The integration of machine learning into accounting software is part of a broader trend of digital transformation in financial services. Globally, businesses are adopting AI-driven tools to enhance decision-making, reduce operational costs, and improve overall efficiency. According to a report by McKinsey, AI adoption could potentially deliver up to $1 trillion in additional value annually across the global banking and insurance sectors by 2030.

For small businesses and freelancers, these advancements could mean a significant reduction in the time spent on financial management. By automating tedious tasks such as expense categorization, business owners can focus more on strategic activities that drive growth and innovation. Furthermore, the enhanced accuracy provided by machine learning can lead to better financial insights, enabling more informed decision-making.

Technical Considerations and Challenges

While the integration of machine learning into FreshBooks presents numerous benefits, it is not without challenges. The effectiveness of ML algorithms depends heavily on the quality and volume of data available. Inconsistent or insufficient data can lead to inaccurate categorizations, potentially affecting the reliability of financial reports.

Moreover, privacy and security are critical considerations. Handling sensitive financial data requires robust security measures to prevent unauthorized access and ensure compliance with global data protection standards, such as the General Data Protection Regulation (GDPR) in Europe.

Conclusion

FreshBooks’ integration of machine learning for expense categorization marks a significant step forward in the evolution of accounting software. By automating and enhancing the accuracy of financial processes, this innovation has the potential to transform how small businesses and freelancers manage their finances. As machine learning technologies continue to advance, the future of financial management software looks increasingly promising, offering new opportunities for efficiency and growth.