Regulatory Tech Maps Fintech Cyber Requirements

In an era where digital financial transactions have become ubiquitous, the intersection of regulatory technology (regtech) and fintech is drawing significant attention. Fintech companies, by virtue of their innovative approaches, are reshaping traditional financial services, but they also face a plethora of cybersecurity challenges. Consequently, regulatory frameworks are evolving to ensure robust cyber resilience within this sector.

The rapid growth of fintech has been accompanied by an increasing number of cyber threats, prompting regulators worldwide to emphasize the importance of cybersecurity compliance. The deployment of regtech solutions is now seen as a critical approach to navigate these complex regulatory landscapes efficiently.

The Role of Regtech in Fintech Cybersecurity

Regtech refers to the use of technology to manage regulatory processes within the financial industry. It offers tools for compliance, reporting, and monitoring, thereby assisting fintech companies in adhering to cybersecurity requirements. The integration of regtech into fintech operations provides several advantages:

- Automated Compliance: Regtech solutions automate the compliance process, reducing the time and resources required to meet regulatory obligations.

- Real-Time Monitoring: Advanced analytics enable real-time monitoring of transactions and activities, helping to detect and respond to cyber threats swiftly.

- Data Protection: Regtech tools enhance data protection by ensuring that sensitive information is handled in accordance with global data privacy regulations.

These capabilities are crucial as regulatory bodies worldwide tighten cybersecurity regulations to protect consumer data and ensure financial stability.

Global Regulatory Trends in Fintech Cybersecurity

Globally, regulators are increasingly focusing on the cybersecurity dimensions of fintech. Several regions have introduced comprehensive frameworks to address these concerns:

- European Union: The General Data Protection Regulation (GDPR) and the Revised Payment Services Directive (PSD2) impose stringent requirements on data privacy and security, impacting fintech operations across Europe.

- United States: The Office of the Comptroller of the Currency (OCC) and the Federal Financial Institutions Examination Council (FFIEC) provide guidelines for cybersecurity risk management in fintech.

- Asia-Pacific: Countries like Singapore and Australia have established robust cybersecurity frameworks, with the Monetary Authority of Singapore (MAS) leading initiatives for fintech security.

These frameworks necessitate that fintech companies adopt advanced cybersecurity measures, and regtech solutions are proving instrumental in achieving compliance.

Challenges Facing Fintech in Regulatory Compliance

Despite the potential of regtech, fintech companies face several challenges in aligning with cyber requirements:

- Complexity of Regulations: The dynamic nature of regulatory changes can make it difficult for fintech firms to keep pace with new compliance requirements.

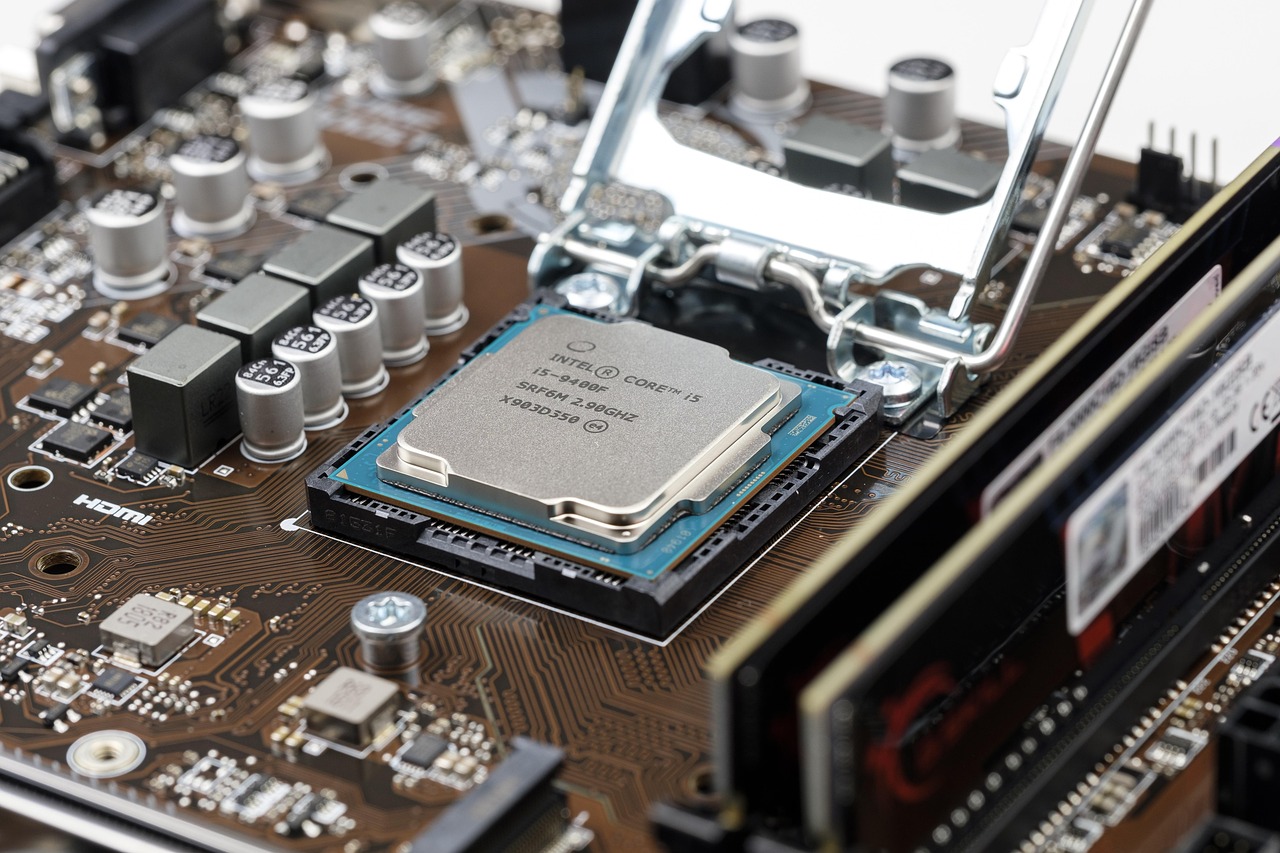

- Integration Issues: Incorporating regtech solutions into existing systems can pose technical challenges, requiring significant investment in infrastructure.

- Cost Implications: While regtech can reduce compliance costs in the long run, initial investments may be prohibitive for smaller fintech startups.

Addressing these challenges requires a strategic approach, with collaboration between fintech firms and regulatory bodies being essential to create a conducive environment for innovation while ensuring cybersecurity.

The Future of Regtech and Fintech Cybersecurity

As the fintech industry continues to grow, the role of regtech in shaping its cybersecurity landscape will become increasingly critical. Future developments are likely to include:

- AI and Machine Learning: Enhancing the capabilities of regtech solutions to predict and mitigate emerging cyber threats.

- Blockchain Technology: Utilizing distributed ledger technology for more secure and transparent compliance processes.

- Global Collaboration: Encouraging international regulatory cooperation to create harmonized standards for fintech cybersecurity.

In conclusion, the integration of regtech into fintech operations is not merely a regulatory necessity but a strategic imperative to ensure the sustainability and security of digital financial ecosystems. As regulatory landscapes evolve, fintech companies must leverage these technologies to navigate cyber requirements effectively, safeguarding both consumer trust and organizational resilience.