Square Integrates Robo-Advisory into Cash App Savings Feature

Square, Inc., a leading financial services and mobile payment company, has announced the integration of a robo-advisory feature into its popular Cash App savings offering. This development marks a significant enhancement in the app’s capabilities, aligning with the global trend towards automated financial services and expanding the range of services available to its users.

The new feature aims to provide users with intelligent, automated financial advice and management tailored to individual savings goals. By leveraging algorithm-driven technology, Square’s robo-advisory service is designed to analyze users’ financial situations and recommend optimal savings strategies. This integration reflects Square’s commitment to democratizing financial services through technology, offering sophisticated financial tools previously accessible only to wealthier clients through traditional financial advisory services.

The introduction of robo-advisory into the Cash App savings feature is particularly relevant in today’s fast-paced financial environment. As consumers increasingly seek convenience and efficiency in managing their finances, automated solutions offer a compelling value proposition. According to a recent report by the World Bank, the global robo-advisory market is expected to grow significantly, reaching an estimated 1.2 trillion USD in assets under management by 2025. This growth is driven by rising consumer demand for cost-effective, personalized financial advice, especially among tech-savvy millennials and Gen Z users.

Square’s strategic move to incorporate robo-advisory services comes at a time when digital transformation is reshaping the financial industry. The integration is expected to enhance user engagement and retention by providing a more comprehensive, user-friendly experience. It also positions Square competitively against other fintech companies offering similar services, such as Robinhood and Acorns, which have already made strides in the automated financial advice space.

Key features of the Cash App’s new robo-advisory service include:

- Personalized Savings Plans: Users can set specific savings goals, such as purchasing a home or planning for retirement, and receive customized savings plans designed to optimize their financial outcomes.

- Automated Portfolio Management: The service automatically adjusts users’ savings portfolios in response to market changes and personal financial situations, ensuring alignment with their long-term objectives.

- Cost Efficiency: By eliminating the need for human advisors, the robo-advisory service offers a more affordable option for users seeking financial guidance.

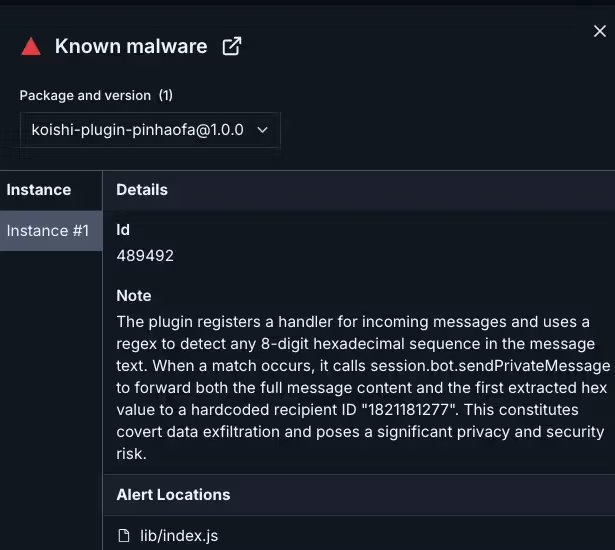

While the integration of robo-advisory into Cash App’s savings feature presents numerous advantages, it also raises questions about data privacy and security. Square has emphasized its commitment to safeguarding user information, implementing robust security measures and adhering to strict regulatory standards to protect sensitive financial data. However, as with any digital financial service, users are encouraged to remain vigilant and informed about their data privacy rights.

In conclusion, Square’s integration of robo-advisory into its Cash App savings feature represents a significant advancement in the company’s service offerings. By providing accessible, automated financial advice, Square is poised to meet the evolving needs of its diverse user base while contributing to the broader trend of digital innovation in financial services. As the fintech landscape continues to evolve, such initiatives underscore the importance of leveraging technology to enhance the accessibility and efficiency of financial management tools for users worldwide.